Financial technology (FinTech) enables the rapid innovation of financial products and services. This presents both opportunities and challenges from a financial stability perspective. The key areas from policymakers and regulators’ perspective are operational risks from third-party service providers, cyber risks, and macro-financial risks.

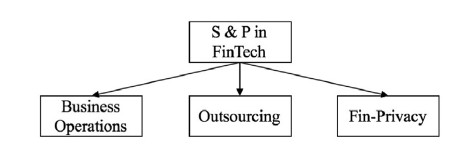

In my opinion, the highest priority issue is related to managing operational risks from third-party providers. Often, a quicker time-to-market may mean that not enough due diligence was done to address the risks of technology adoption. According to a survey (Gai, Qiu and Sun), a breakthrough in technologies such as big data, image processing, mobile networks, etc. has created complicated integrated systems with distinctive demands for financial services offerings. From a technical perspective, both the financial industry and regulators should consider issues across five dimensions: security and privacy, data techniques, applications, facility and equipment, and service models.

A summary review of the issues is presented below.

- In FinTech applications, security and privacy are paramount; for example, in payments, money transfers could risk data of many consumers if privacy by design principles and cyber-security practices are not followed by FinTechs.

- Data techniques are critical as many technology systems become important to provide services. For example, in P2P lending data-oriented issues become a priority as data use via data analytics and models will play a key role in as both hardware and software required to provide the services become critical to the functioning of the FinTech services.

- FinTech applications and their management are essential as their wide adoption can change industry practices e.g. Robo-advisors that rely on machine learning and algorithms, can provide speed efficiency and cut costs to serve customers, and therefore, regulators should consider financial data governance frameworks. If third parties are concentrated, then this could increase operational risks as parties are interdependent.

- The use of facilities and equipment will also be a high priority. Data controls in the cloud can have unpredictable vulnerabilities due to the usage of virtual machines and physical locations of servers which may come under different regulatory environments. This may also pose legal risks.

- New FinTech service models that require high computing performance or integrations with smart city or cloud computing could also present cyber and operational risks.

In summary, FinTech companies will get first-mover advantage with their unique business models but incorporating cybersecurity and privacy principles will reduce the risks associated with the new business models and promote financial stability.

Works Cited

FSB. “Financial Stability Implications from FinTech.” 2017.

Gai, Keke, Meikang Qiu and Xiaotong Sun. “A survey on FinTech.” Journal of Network and Computer Applications (2018): pp.262-273.

Featured Image Credit: Photo by Aaron Sebastian on Unsplash