Algorithms provide businesses with more efficient ways to manage their data; however, they are not without problems. On the bright side, algorithms provide certain predictability to business models. They can be relied on for precise decisions and information on what will drive the key metrics. On the darker side, algorithms can increase business risks. Can… Continue reading House-Flipping Algorithms: How An American Tech Real-Estate Marketplace Company Lost Millions Flipping Houses

Author: Ravi Dugh

Top Machine Learning and Deep Learning Frameworks and Libraries

Machine Learning frameworks and libraries are the tools that help develop and deploy machine learning models. The most popular ML frameworks are TensorFlow, Keras, and PyTorch. Please see Figure 1. TensorFlow is an end-to-end open-source platform that was created with the goal of improving machine learning. The Google Brain team developed TensorFlow for internal Google… Continue reading Top Machine Learning and Deep Learning Frameworks and Libraries

A Quick Guide to Machine Learning Algorithms

Machine learning has become ubiquitous in many industries. Online retailers use machine learning to predict what customers will buy, doctors use it to diagnose illnesses, and marketers use it for targeted advertising. These are just a few examples of how machine learning can be applied to improve our society. I present you here over 20+… Continue reading A Quick Guide to Machine Learning Algorithms

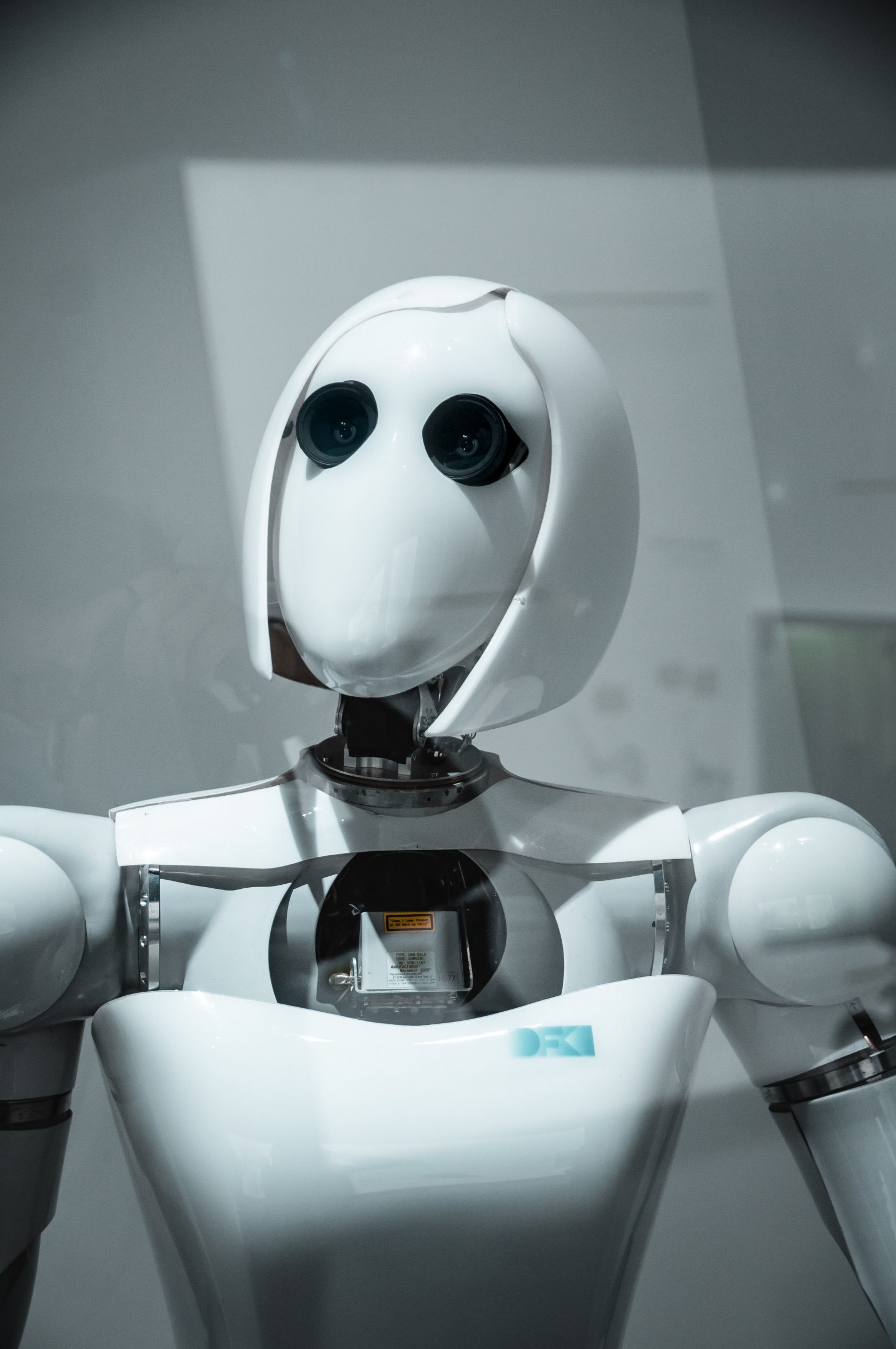

What Every Business Executive Needs To Know About Artificial Intelligence and Machine Learning

Artificial Intelligence (AI) and machine learning (ML) have been hot topics the last few years, and for a good reason. With AI, we can do previously impossible or costly to do things. Artificial intelligence is also benefiting businesses by automating processes, saving time and money, and improving customer experiences. But what every business leader must… Continue reading What Every Business Executive Needs To Know About Artificial Intelligence and Machine Learning

The Third Wave of AI and The Digital Organizations of the Future

Many AI techniques are being used in organizations, and AI will continue to get sophisticated in the third wave of AI. In the Fourth Industrial Age, human creativity, AI at scale, and Emotion AI will be dominant forces that will shape the digital organizations of the future. What is the Third Wave of AI? In… Continue reading The Third Wave of AI and The Digital Organizations of the Future

Three FinTech Companies That Used Privacy By Design Principles To Offer A Unique Value Proposition To Customers

Privacy By Design Principles In the 1990s, Anne Cauvokian introduced privacy by design (PbD) principles that could strike a balance between big data analytics and individual privacy. The principles are outlined below (A. Cavoukian, Operationalizing Privacy by Design: A Guide to Implementing Strong Privacy Practices): Proactive, not reactive; preventive not remedial Privacy as the default setting… Continue reading Three FinTech Companies That Used Privacy By Design Principles To Offer A Unique Value Proposition To Customers

Costco vs. Walmart: Employee Experience Is A Competitive Advantage

Employee ExperienceWhat is good for employees is good for business. Employee experience matters; according to an article by Susan Galer, employee experience is linked to higher business value and successful digital transformations. Further, engaging employees to deliver operational improvements is important to gain more than just incremental improvements from technology investments (Source: Gartner report). Finally,… Continue reading Costco vs. Walmart: Employee Experience Is A Competitive Advantage

Data Analytics For Competitive Advantage

According to the Capgemini report1, only a small minority of consumer products (16%) and retail companies (6%) use data analytics to gain an edge from data. Such companies are data masters as they have the ability to understand the importance of storytelling skills. A data-powered company embeds the insights into the core business process and… Continue reading Data Analytics For Competitive Advantage

FinTech and Financial Stability

Offering innovative financial services requires data-driven applications of financial technologies. Issues of security and privacy play an integral role in maintaining financial stability

Uber is relying on network liquidity to turn to profit

Improving margins for Uber is dependent on the network effects of liquidity provided by drivers and riders. For the quarter ending December 31, 2018, Uber had 91 million and 3.9 million, MAPCs (Monthly Active Platform Consumers) and drivers, respectively. Uber is the world’s largest ridesharing platform. In 2018, The company had Gross Bookings of $49.8B,… Continue reading Uber is relying on network liquidity to turn to profit