Employee Experience

What is good for employees is good for business. Employee experience matters; according to an article by Susan Galer, employee experience is linked to higher business value and successful digital transformations. Further, engaging employees to deliver operational improvements is important to gain more than just incremental improvements from technology investments (Source: Gartner report). Finally, employee experience and compensation can boost revenues (Source: payscale), and fair compensation is a key component of employee experience.

Let’s switch discussions on a particular point by taking the example of Walmart and Costco. I have always thought about these two companies and having shopped at both, and I did feel better at shopping at Costco as I knew employees are paid well. Recently, I came across an interesting debate on LinkedIn, and there was a post by Dan Price. The post talks about the minimum wages and average pay at Costco ($24/hr) and Walmart ($15/hr). Further, it goes into making a point about corporate choices and compensation to employees vs. returns to shareholders.

The above post raises a variety of issues but is it really about different operating models, which includes the product mix and business practices. Then there is something else, which I have always wondered – Does the employee experience matter?

Financial Metrics

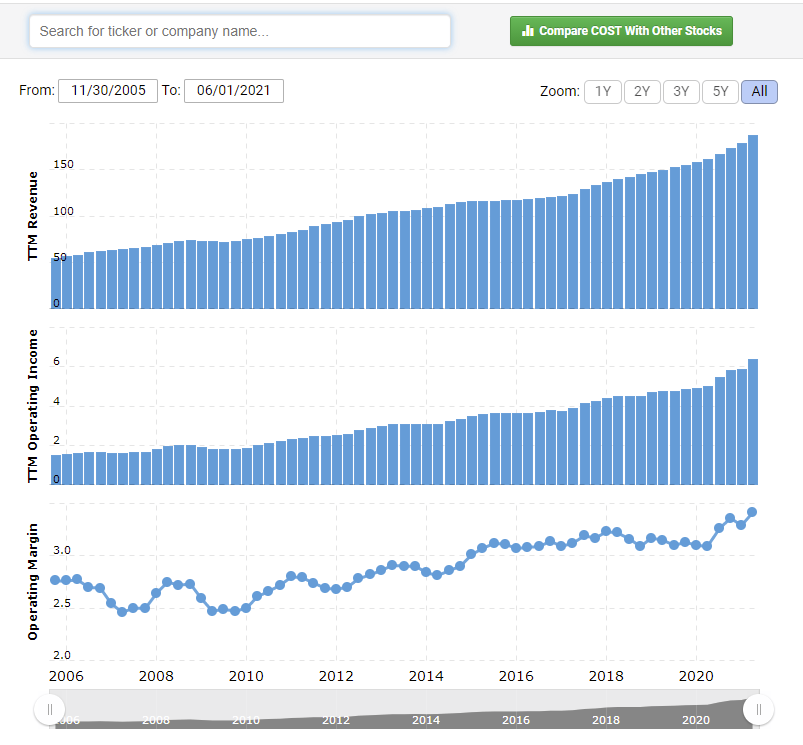

Let’s review Costco’s key metrics (below). I see a steady growth in revenues, operating income and operating margin.

Let’s review Walmart’s key metrics (below). I see a steady increase in revenues but the operating income has not been steadily improving. Further, the operating margin is lower now than it was anywhere in the last 5 to 15 years.

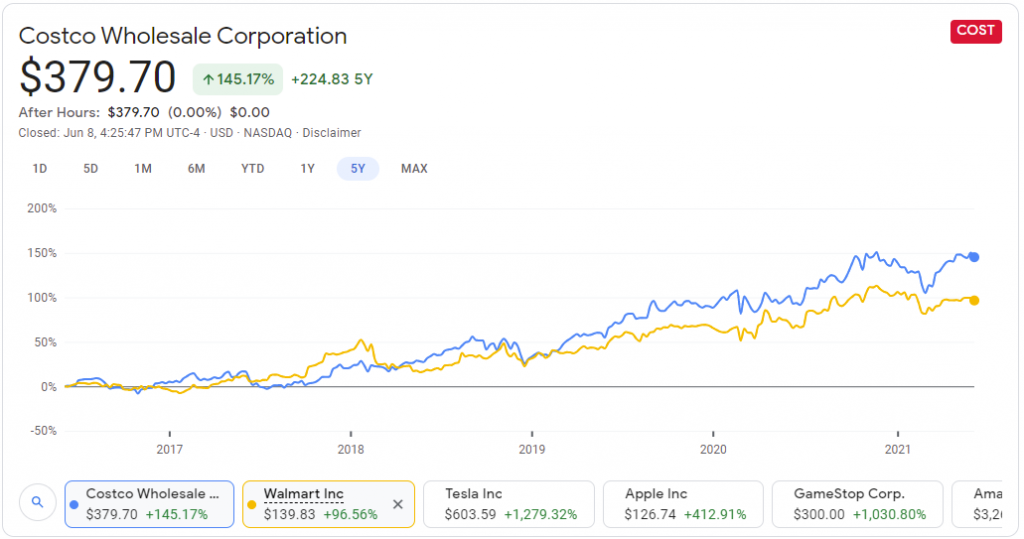

In summary, the operating margins for both companies are similar ~3%. This may lead you to believe that the payoff to shareholders, the pie is no different, but this couldn’t be farther from the truth.

Check the chart above, which company’s shareholder’s made a better return – obviously, Costco’s. In fact, the return is about 50% higher over the last five years.

What do these companies say about their employees?

Costco 2020 AR “With respect to the compensation of our employees, our philosophy is not to seek to minimize their wages and benefits. Rather, we believe that achieving our longer-term objectives of reducing employee turnover and enhancing employee satisfaction requires maintaining compensation levels that are better than the industry average for much of our workforce. This may cause us, for example, to absorb costs that other employers might seek to pass through to their workforces. ”

A quick search in Costco 2020 AR for “employees”, 45 results in 84 pages.

Walmart 2020 AR “We believe our relationships with our associates

are good. A large number of associates turn over each year, although Walmart U.S. turnover has improved in recent years as a

result of our focus on increasing wages and providing improved tools, technology and training to associates.”

A quick search in Walmart 2020 AR for “employees”, 15 results in 88 pages.

Other Factors That Affect Profitability

A company’s profit depends on the number of products that it sells and how much profit it can make per product. A typical Costco warehouse carries only 3,700 distinct products, while a typical Walmart Supercenter carries approximately 140,000 products. Further, Costco’s annual membership fees (US$60/year for Gold Star, US$120/year for Executive as of 2019) account for 80% of Costco’s gross margin and 70% of its operating income. (Source: Wikipedia)

While Walmart may have a large number of products and a complex supply chain to manage its efficiency (it is probably doing a great job at it) but given that operating margins are relatively similar, it is really up against a company (Costco) that has a business model that truly cares for its employees and pays them better wages. Many will agree that it is hard to beat the advantage that comes from better employee experience.

Employee Experience Is A Competitive Advantage

Employee experience can translate to competitive advantage as it pervades the culture, technology, and physical space. (Source: PwC – Why employee is the new customer)

It found that experience-led organisations that create places people want to work at are four times more profitable, generate double the average revenue yet are 25% smaller than non-experience led organisations. They are therefore more productive and innovative. Employee experience is the key to a competitive advantage.”

Source: PwC Report

Regarding successful digital transformations, the BXT approach by PwC emphasizes that technology first is not necessarily the best approach for digital transformations as other areas of the business need a revival too.

Conclusion

Employee experience matters more than you think. Costco vs. Walmart salary differences can be attributed to different business models and corporate values. Both companies are successful, but the compensation averages are different, and compensation is a big component in employee experience. When compared with Costco, Walmart has big investments in technology, and an organization with a better employee experience is likely to have a higher rate of successful digital transformations. In summary, successful digital transformations require cultivating a culture of innovation and disruption, and it relies on improving employee experience. Any company’s payoff of investing in employee experience will be seen in its long-term competitive advantage.

#DigitalTransformation #EmployeeExperience #Strategy #Retail #Compensation #Technology

Sources:

Paid Program: How Improving the Employee Experience Boosts Profits (wsj.com)

Gartner Top 10 Strategic Technology Trends for 2020 – Smarter With Gartner

How Employee Experience and Compensation Can Boost Revenue (payscale.com)

Post | Feed | LinkedIn

Costco Operating Margin 2006-2021 | COST | MacroTrends

Walmart Operating Margin 2006-2021 | WMT | MacroTrends

2020 Costco Annual Report

2020 Walmart Annual Report

Costco Wholesale Corporation (COST : NASDAQ) Stock Price & News – Google Finance

Costco – Wikipedia

Why the employee is the new customer (pwc.com.au)

The BXT approach: Widening perspectives on digital transformation (pwc.com.au)

Cover Image credit: Photo by krakenimages on Unsplash